507 views Yakuza’s Shift to White-Collar Crimes and Fraud: A Modern Survival Strategy

For decades the Yakuza were a symbol of Japan’s underworld: tattooed gangsters, old‑school codes, and brutal turf wars. Under the radar of the public eye but firmly rooted in the annals of organized crime, the Yakuza’s historic legacy was tied to extortion, gambling, and illicit trafficking. In recent years, however, a subtle yet profound shift has unfolded. The Yakuza’s survival calculus has migrated from streets to boardrooms, from pickpockets to pyramid schemes, and—most significantly—into the realm of white‑collar crimes and sophisticated fraud.

Why White‑Collateral? A Strategic Pivot

- Erosion of Traditional Revenue Streams: Domestic consumption downturns and stricter law‑enforcement clampdowns have hurt gambling, prostitution, and loan‑sharking sectors.

- Technological Disruption: The digital age enables high‑value fraud with minimal physical presence.

- Legal Skin‑Deep: White‑collar criminality often remains less conspicuous; financial crimes can slip under the radar of conventional policing.

- High‑Profit, Low‑Risk Ratio: Corporate fraud, money laundering, and cyber‑scams can generate millions with a fraction of the manpower required for street‑level assaults.

This adaptation is headlining a trajectory seen in organized crime globally—Al Capone’s organised extortion gave way to the modern Italian Mafia’s infiltration of legitimate businesses, and the Russian “thieves in law” now sponsor cyber‑operations.

The Zoning Map: How the Yakuza Rewire Boards and Banks

1. Infiltration of Financial Institutions

- Front‑End Cultivation: The Yakuza cultivates junior staff or intermediary contractors—often former youth workshop workers—who deliver services to banks and investment firms.

- Layered Identity: Utilizing Japan’s casual residency visa management, operatives adopt pseudonyms on KYC (Know‑Your‑Customer) platforms, creating a paper trail that is difficult to parse.

- Use of Offshore Holdings: Swiss, Cayman, and Singaporean trusts frequently act as unwitting conduits for Yakuza bankrolls.

2. Money‑Laundering via Loopholes

- Real‑Estate Opportunism: Purchasing properties via shell corporations shrouds dirty money in legitimate capital.

- Cryptocurrency Castles: The rising popularity of Bitcoin and Ethereum provides an attractive, semi‑anonymous deposit system.

- Trade‑Based Laundering: Over‑or‑under‑invoicing on export/import deals smuggles money out of Japan, leaving minimal audit footprints.

3. Fraud in Corporate Takeovers

- The “Buy‑and‑Fold” technique: Stakeholders acquire a minority share in a mid‑tier corporation, then instigate forced asset sales that inflate a buy‑out.

- Buzz‑Oriented M&A: By sponsoring front‑end marketing for ostensibly promising start‑ups, Yakuza merchants siphon venture capital before quietly transferring assets to affiliates.

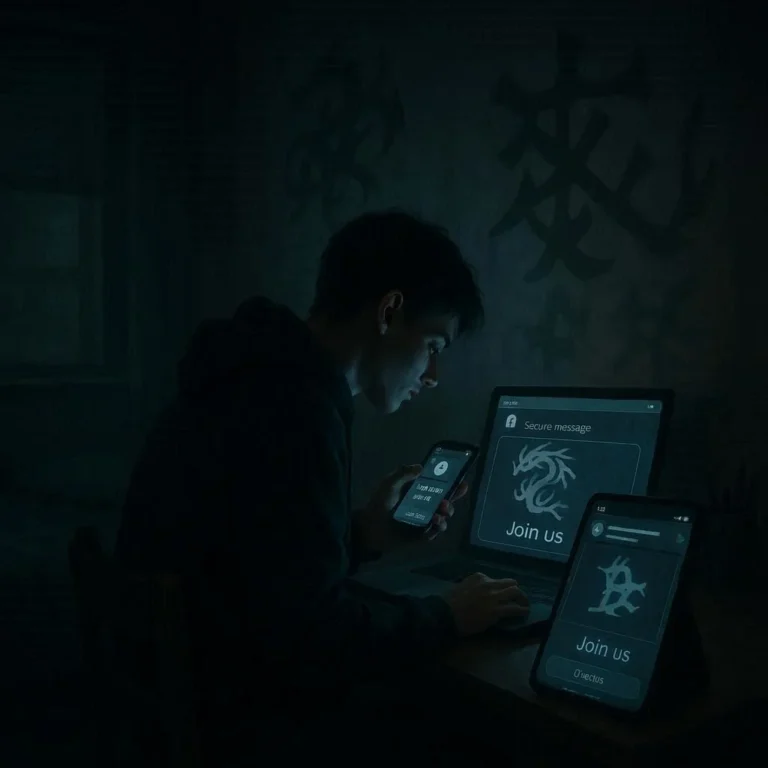

4. Cyber‑Fraud and Ransomware

- Targeted Phishing: Attackers craft industry‑specific spear‑phishing attempts, demanding ransom or threatening to leak proprietary intellectual property.

- Supply‑Chain Exploitation: Interpreting the Yakuza’s “familial ties” strategy, operatives infiltrate vendor directories, installing malware that intercepts transaction data.

Case Studies: Yakuza Linked Fraud in the Wild

| Incident | Year | Sector | How It Unfolded | Outcome |

|———-|——|——–|—————–|———|

| The Sakura Scam | 2019 | Financial Services | A Yakuza‑owned shell company obtained multiple corporate loan accounts by presenting forged KYC documents. | Japan Monetary Authority seized assets; 3 acquitted of extortion but fined heavily.

| Nikkei‑Lite Ponzi | 2021 | Media & Advertising | Operatives convinced sponsors that a multichannel media venture would double returns after “an exclusive content launch.” | Over $75m of sponsor capital lost; arrests sparked nationwide review of media financing.

| J‑Cash Crypto Heist | 2022 | Cryptocurrency | An insider introduced a software developer who program’d a backdoor within a payment‑gateway API; he siphoned millions in BTC. | The developer was extradited; Yakuza surveillance network expanded.

The Echoes on Law Enforcement and Policy

The Yakuza’s white‑collar shift challenging law enforcement has produced a series of tactical shifts:

- Cross‑Agency Intelligence Sharing: The National Police Agency (NPA) and the Japan Financial Services Agency (JFSA) now hold joint task forces, pooling forensic accounting resources.

- International Cooperation: With the OECD’s Global Organized Crime Initiative, Japan cooperates with U.S. FINRA and EU AML monitoring for supply‑chain disruptions.

- Regulatory Reforms: 2024 saw amendments to the Anti‑Money Laundering Law, tightening thresholds for KYC for certain industry segments.

Business Survival Tactics: Protecting Your Company

- Implement Robust KYC Protocols: Invest in AI‑driven identity verification that flags multiple accounts linked to the same IP addresses.

- Regular Audits of Vendor Relationships: An independent audit of all third‑party vendors can expose hidden ownership patterns.

- Employee Training on Security Awareness: Cyber‑phishing protection should become a core part of mandatory employer onboarding.

- Transparent Transfer Pricing: Rigorous documentation reduces the risk of a trade‑based laundering red flag.

Forecast: Yakuza Strategies for the Next Decade

- Artificial Intelligence in Fraud: Yakuza might commission AI toolkits for auto‑generation of fraudulent documents.

- Deep‑fake Manipulation: Deceptive executive communication could be used to redirect corporate decisions.

- Decentralized Finance (DeFi) Leveraging: By integrating with DeFi protocols, the Yakuza can bypass many traditional banking restrictions.

But modelling these tactics also means developing counter‑measures—holistic corporate governance frameworks, continuous risk scanning, and real‑time anomaly detection.

Final Thoughts

The Yakuza’s migration from the alleys of Japan to the boardrooms of global finance is a stark reminder that organized crime is perpetually evolving. This white‑collar metamorphosis is not merely a temporary trend; it is a survival strategy that leverages the very infrastructure businesses depend upon. For investors, policymakers, and corporate guardians, the battlefield shifts from dice‑and‑swords to digital ledger‑and‑lawbook. Understanding this pivot is essential, because the next generation of Yakuza‑affiliated crime will hit inside the systems you trust.