508 views The Economic Networks of Japan’s Modern Underworld

The underworld in Japan—often euphemistically referred to as yakuza—has long been a paradoxical blend of tradition and modernity. While most tourists and locals think of tattooed thugs fighting in neon‑lit back alleys, the reality is far more complex: the yakuza operate sophisticated economic networks that permeate legitimate industries, shape regional development, and even influence national policy. In this exploration, we’ll trace how these clandestine actors have evolved, the mechanisms they use to channel money, their modern-day economic footprint, and what the Japanese state is doing to combat them.

1. From Gokudō to Global Footprints

The roots of Japan’s organized crime can be traced back to the bakufu era, when samurai and merchants formed informal protection groups. By the 20th century, the gokudō (five rings) had crystallized into an underground empire with a quasi‑bureaucratic structure: kōshi (leaders), kumiai (clans), and bōzoku (gangs). Today, yakuza organization is not a single monolithic entity but a mosaic of clans such as the Kumamoto Group, Hiroshima Group, and Yamaguchi-gumi, each with thousands of members spanning real‑estate, finance, entertainment, and even cyber‑crime.

Unlike Western mafias, the Japanese underworld historically maintained a tacit ritualization. Their code of conduct—giri (duty) and ninjo (empathy)—dictated how they treated outsiders and how they interacted with legitimate businesses. They wielded patronage over local vendors, created protection rackets, and in some cases, took over construction contracts for infrastructural projects. This synergy enabled them to embed themselves into the economic fabric of urban and rural Japan alike.

2. The 24‑Hour Economy – Money Channels

2.1 Cash‑Based Ventures

A core feature of the yakuza’s financial ecosystem is their preference for cash transactions. While Japan has historically been a cash‑centric culture, the late 20th century money‑laundering techniques evolved: gifts (giri kaoshi), over‑oriented cash deposits, and installment sale schemes coupled with hefty interest rates. These channels enabled them to disguise illicit profits as legitimate business income.

2.2 Real‑Estate Investments

Real‑estate is a favorite laundering conduit. Yakuza members invest in commercial properties—hotels, amusement parks, and logistics hubs—creating a façade of legitimate revenue streams. They often own parking spaces that see high proxy traffic. Furthermore, they use property to create opulent mansions for “social” gatherings, embedding wealth into the real‑estate ledger and reducing traceability.

2.3 Financial Institutions and Investment

While criminal organizations are legally barred from owning mainstream banks, they maneuvered through loan sharks, money‑exchange points, and investment syndicates. Recently, fintech disruptions have opened new pathways: crypto‑currencies, digital wallets, and peer‑to‑peer lending platforms. Yakuza groups have been known to set up “shell” accounts that funnel digital currency into legitimate trading platforms abroad.

2.4 The Entertainment and Media Corridor

P‐store (video rental) chains, karaoke bars, and adult entertainment venues have historically served as money‑laundering hubs. In modern times, concert promotion, TV production, and agency management have become fertile fields for laundering through multi‑layered invoicing, suspenseful fee structures, and sometimes through partnership with local talent agencies. “Exclusive” sponsorship deals on sporting events or fashion shows offer a clean cover for illicit income.

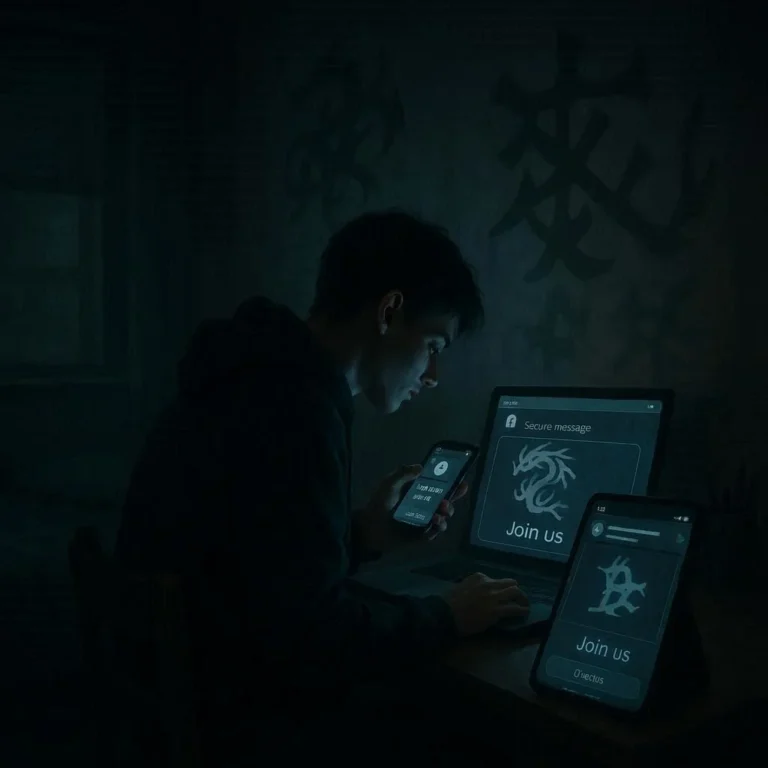

3. The Digital Shift – A New Frontier

The 2000s brought the internet—and the underworld’s adaptation to it. Yakuza firms established “hacker” groups to conduct online phishing, ransomware attacks, and wholesale cyber‑crime. These endeavours supplement wealth, providing liquid capital that can be re‑introduced into traditional sectors. The concept of “millionaire hackers” has democratized wealth acquisition, enabling small gang affiliates to siphon off substantial revenues.

Digital infiltration also includes targeted scams: phishing of high‑net‑worth individuals, identity theft, and manipulating stock exchanges through inside information. The yakuza leverage these illicit streams to invest heavily in cryptocurrency mining farms, a real estate‑driven cyber‑biotechnology backbone.

4. Political Leverage – The Old and New Power

Unlike many OECD nations where politics and organized crime’s connection is limited to dispute over taxation or land deals, Japanese underworld actors have succeeded in embedding themselves in local and national governance. Yakuza members often hold nominators—supporters who vote in local elections—to ensure that political appointments favor their business interests. They invest cash for keiretsu — group of companies that shield each other from hostile takeovers.

In prominent cases, officials have accepted yakuza‑funded donations disguised as campaign contributions. The 2018 Takaichi Incident exposed how yakuza-controlled construction firms manipulated municipal projects for massive profit, further highlighting the dangerous nexus between urban development and organized crime.

5. Economic Impact – The Double‑Edged Sword

5.1 Positive Externalities? (A Nightmarish Illusion)

Locally, the yakuza’s presence can create jobs. They maintain night‑life venues, supply local street vendors, and provide “security” services that claim to protect town residents from mischief. They often set up employment identity forms that mask an open‑air bar with a distribution center, both occupying a single tax‑paid lease and employing up to 200 staff in the region.

5.2 Hidden Costs

More often, these “jobs” are irregular, unpaid, or exploitative, especially for low‑skill migrants or trade workers who find themselves over‑charged for services. Property damage, bribery scandals, and the suppression of competition generates a hidden economic cost. The laundering cycles also lead to corporate overvaluation and depress genuine business growth, creating pockets of sluggish local economies.

In the long run, serious studies estimate that the yakuza’s illegal profit drain is equivalent to over 1/10 % of Japan’s GDP—estimated at $80 B annually—a staggering figure that can distort financial markets, inflation trends, and foreign investment attractiveness.

6. The Law and the Future – A Road to Clean Streets

6.1 Legal Reforms

Japan’s legal system has gradually tightened restrictions against the yakuza. The 1998 Anti‑Organized Crime Law, updated in 2009, prohibits business activities that directly or indirectly provide financial support to known criminal organization members. In 2018, the Anti‑Organized Crime Act enhanced criminal penalties for cooperation with yakuza, making it harder to navigate the black‑and‑white lines.

The Special Criminal Procedure Law allows police agencies to investigate corporations that have yakuza ties—companies that maintain shares or receiving subsidiaries that have had yakuza investors. This has been pivotal in clamping down on affiliates like Nippon Yasuindo enterprises.

6.2 Tech Solutions

Japan is investing in blockchain transaction monitoring, AI‑based fraud detection, and cross‑border data sharing to dismantle money‑laundering networks. Police agencies partner with tech giants—like SoftBank and Rakuten—to deploy real‑time analytics on large transactions that might trigger yakuza networks.

6.3 Societal Attitude Shift

The 2020 Influential Media Campaign highlighted stories of families that lost their homes to yakuza‑driven real‑estate deals. Public schools are educating 14‑year-olds about the risks of organized crime beyond the visual punch of printed logos. This cultural shift is crucial, as many yakuza alliances rely on “social pressure” and “maidens of honor” to sustain loyalty.

7. Conclusion – Navigating the Underworld’s Economic Tangle

Japan’s modern underworld is less a monolith of violent outlaws and more an economic network that weaves through the corridors of finance, real‑estate, and digital technology. Its presence brings transient jobs and “protection” but also inflates costs, distorts markets, and permeates politics. Over the last decade, legal reforms, technological innovation, and societal awareness have cut through some of its veil. Yet a silent, tenacious network continues to crawl beneath legitimate institutions.

For policymakers, the lesson is dual‑fold: strengthen legal frameworks while harnessing technology for real‑time monitoring; simultaneously, cultivate a societal awareness that sees organized crime as a multi‑faceted threat, not just a cultural myth. With these strategies, Japan can continue to thrive on its economic power while pushing its organized crime networks into the shadows where they belong.

Key Takeaways

- Yakuza networks operate through cash, real estate, financial, entertainment, and cyber‑crime channels.

- Digital technology has ushered in new laundering methodologies.

- Political influence remains a potent lever for yakuza control.

- Recent legal reforms and AI monitoring are curtailing their economic holdings.

- Societal change is essential to sever the cultural bond that sustains underworld loyalties.